The African Export-Import Bank (Afreximbank) and Zep-Re (PTA Reinsurance Company) have launched the Trans-Africa Bond Alliance (TABA), a strategic initiative aimed at addressing Africa’s insurance capacity gap and enhancing cross-border trade efficiency.

TABA is designed to support African contractors in securing construction and procurement projects while also facilitating the movement of goods and investment across the continent. By introducing a streamlined transit guarantee mechanism, the alliance seeks to reduce trade barriers, lower costs, and improve supply chain efficiency under the framework of the African Continental Free Trade Agreement (AfCFTA).

With 110 borders and 16 landlocked countries, Africa faces logistical and financial challenges in trade. High transport costs, sometimes exceeding the value of traded goods, continue to hinder economic growth. TABA aims to address these inefficiencies by enabling businesses to transport goods seamlessly from Cape Town to Cairo using a single transit bond, reducing delays and ensuring customs authorities receive guaranteed revenue in case of procedural breaches.

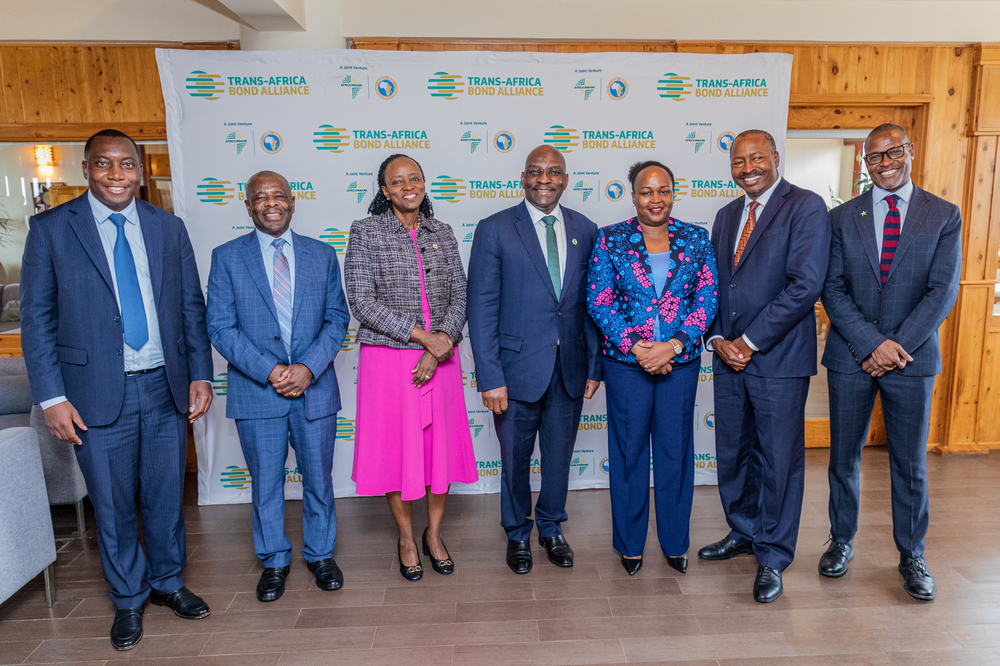

Speaking at the launch, H.E. Veronica M. Nduva, CBS, Secretary General of the East African Community (EAC), highlighted the alignment of TABA with regional integration goals. “The East African Community has long been committed to fostering regional integration and economic development. The establishment of TABA aligns seamlessly with our program to enhance cross-border trade, reduce costs, and promote economic growth across Africa with simplified trade regimes,” she said.

Afreximbank and Zep-Re, key institutions in Africa’s trade finance and insurance landscape, bring their expertise to the initiative. Since its founding in 1993, Afreximbank has played a pivotal role in trade finance and facilitation, while Zep-Re has been a key player in supporting trade insurance solutions.

Denys Denya, Senior Executive Vice President of Afreximbank, emphasized TABA’s role in reducing trade fragmentation. “Through this collaboration, we aim to strengthen interstate transit regimes and pave the way for a continental framework under AfCFTA. Our goal is not to displace local operators but to enhance trade efficiency and investment flows across Africa,” he said.

Hope Murera, Managing Director and CEO of Zep-Re, underscored the initiative’s impact on Africa’s trade ecosystem. “TABA represents a shared vision—one where Africa is connected by bridges of opportunity, not barriers. This initiative will transform how we facilitate trade, manage risk, and support cross-border movement,” she said.

TABA’s approach leverages Transit Bonds, Performance Bonds, and Standby Letters of Credit (SBLCs) to guarantee the secure movement of goods. The initiative is expected to:

- Enhance trade efficiency by eliminating delays caused by multiple national bond requirements.

- Boost investor confidence through a structured and transparent customs guarantee system.

- Reduce trade costs, making African exports more competitive.

- Ensure compliance with customs regulations, preventing illicit trade and securing government revenue.

- Expand market opportunities for African businesses through smoother cross-border trade.

Following the launch, stakeholders will engage in business-to-business (B2B) discussions to explore implementation strategies. An awareness campaign will also be rolled out to educate businesses and financial institutions on TABA’s benefits and operational framework.

The Trans-Africa Bond Alliance (TABA) is a continental initiative aimed at revolutionizing trade facilitation through a unified transit bond system. It seeks to lower trade costs, ensure compliance with customs regulations, and support the broader goals of AfCFTA in creating a single market for goods and services across Africa.

The African Export-Import Bank (Afreximbank) is a Pan-African multilateral financial institution dedicated to financing and promoting intra-African and international trade. Since its establishment in 1993, Afreximbank has played a key role in accelerating industrialization and regional trade. The bank is also behind initiatives such as the Pan-African Payment and Settlement System (PAPSS) and a US$10 billion AfCFTA Adjustment Fund. As of December 2023, Afreximbank’s total assets and contingencies stood at over US$37.3 billion, with shareholder funds amounting to US$6.1 billion.

Zep-Re (PTA Reinsurance Company) is a regional reinsurance organization established to support the trade insurance sector in Africa. With extensive experience in risk management and flagship regional programs, Zep-Re plays a crucial role in strengthening Africa’s financial ecosystem and supporting businesses through specialized trade insurance solutions.