The Kenya Revenue Authority (KRA) has launched a new Electronic Rental Income Tax System (eRITS) aimed at streamlining tax compliance in the real estate sector. The system, built on the government’s Enterprise Integration Platform—Gava Connect—is designed to simplify the process of filing, computing, and paying rental income tax for landlords and property managers.

eRITS is accessible through both the Gava Connect API for system integration and the eCitizen platform as a self-service tool. KRA says the system is a voluntary compliance mechanism, intended to encourage landlords to meet their tax obligations with ease.

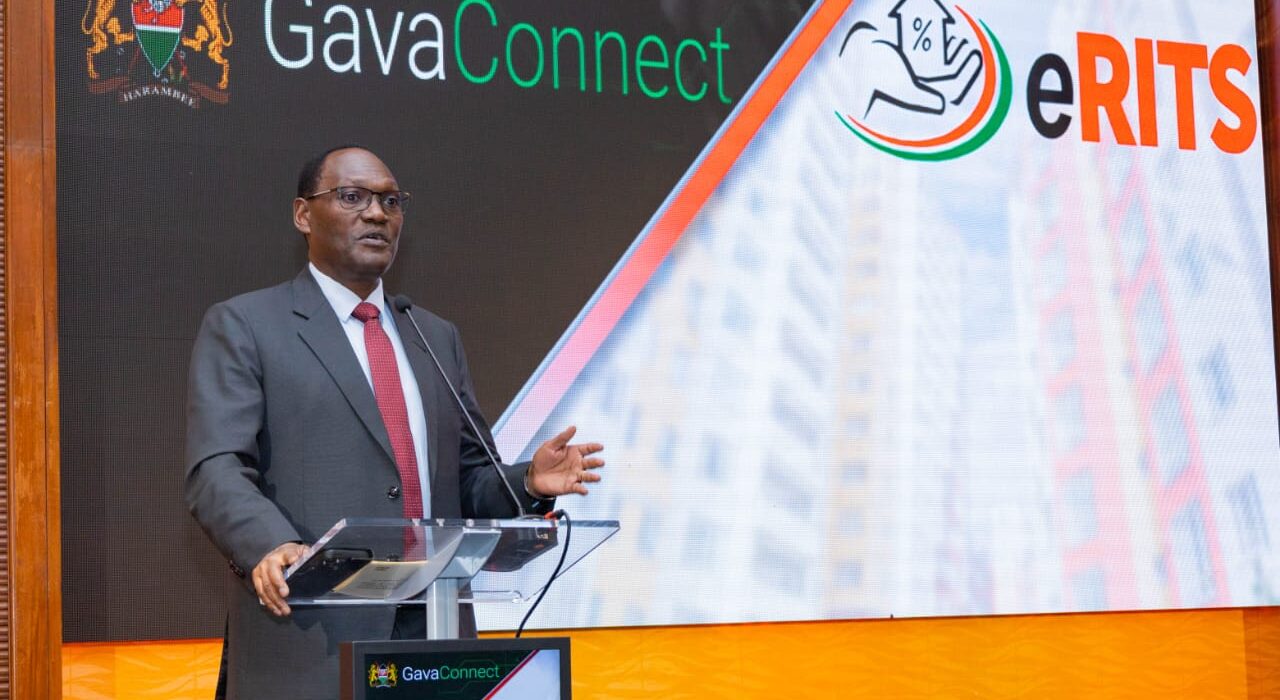

Speaking during the launch event, Principal Secretary to the National Treasury Dr. Chris Kiptoo described the initiative as a step toward building a more efficient and equitable tax environment in Kenya.

“With eRITS, we are moving towards a smarter, more efficient tax system that benefits everyone. The government is committed to ensuring tax compliance is as seamless as possible,” he said. “The goal is not only to raise revenues but also to create a predictable tax environment that promotes national development.”

Housing Secretary Mr. Athman Said, from the State Department of Housing and Urban Development, added that eRITS will be a critical enabler in turning the real estate sector into a stronger contributor to the economy through formalized tax revenue streams.

KRA Commissioner General Humphrey Wattanga emphasized that the system reflects KRA’s continued focus on leveraging technology to improve service delivery.

“eRITS is a voluntary compliance tool. It integrates fully into the KRA ecosystem to support real-time tax computation, filing, and payment,” said Mr. Wattanga. “It represents our commitment to reducing administrative burdens while enhancing revenue mobilization through digitization.”

The rollout of eRITS comes amid growing focus on formalizing income within Kenya’s burgeoning real estate sector. Since the introduction of the Monthly Rental Income (MRI) tax regime in 2016—targeting landlords earning between KES 288,000 and KES 15 million annually—the government has been refining its approach to ensure wider compliance.

Notably, the MRI tax rate was lowered from 10% to 7.5% effective January 1, 2024, as part of efforts to ease the tax burden on compliant landlords and incentivize voluntary registration.

According to KRA data, tax collections from MRI rose to KES 14.4 billion in the 2023/2024 financial year, up from KES 13.6 billion the previous year and KES 12.3 billion the year before that—reflecting a steady 5.2% year-on-year growth.

The Authority is banking on eRITS to further close the compliance gap by offering a user-friendly system that supports transparency, reduces paperwork, and encourages landlords to meet their tax obligations without coercion.

The launch aligns with KRA’s broader digital transformation agenda and the government’s goal of increasing domestic revenue while formalizing previously under-taxed sectors of the economy.