SACCOs are cooperative financial institutions where members pool their resources to save, borrow, and invest. Regulated by the Sacco Societies Regulatory Authority (SASRA), many SACCOs in Kenya are classified as deposit-taking (DT) or non-withdrawable deposit-taking (NWDT). DT SACCOs offer Front Office Service Activities (FOSA), allowing members to access banking-like services, such as withdrawable savings accounts, while NWDT SACCOs focus on non-withdrawable savings for long-term goals.

Saving with a SACCO offers distinct advantages over traditional banks, particularly for low- and middle-income earners, entrepreneurs, and diaspora Kenyans. Here’s why SACCOs are a preferred choice:

- Affordable Loans: SACCOs provide loans at lower interest rates (often 1% per month on reducing balance) compared to banks, typically allowing members to borrow up to 3–4 times their savings.

- High Dividends: Members earn dividends on their share capital, often ranging from 10% to 21%, and interest on savings, offering better returns than many bank accounts.

- Financial Inclusion: SACCOs cater to specific communities, such as teachers, police officers, or farmers, making financial services accessible to underserved groups.

- Community Support: SACCOs reinvest funds into local projects, fostering socioeconomic development.

- Financial Literacy: Many SACCOs offer training programs to help members manage their finances effectively.

However, not all SACCOs are equal. Some have faced challenges with mismanagement or financial instability, making it crucial to choose a reputable, SASRA-regulated SACCO.

Top 10 SACCOs in Kenya for Savings in 2025

Based on recent data, financial performance, member reviews, and industry recognition, the following SACCOs stand out as the best for savings in Kenya. Each is evaluated for its asset base, dividend payouts, loan offerings, technological innovation, and customer service.

1. Mwalimu National SACCO

Overview: Established in 1974, Mwalimu National SACCO is the largest SACCO in Kenya and Africa, with an asset base of Ksh 66.43 billion and over 123,000 members. It primarily serves teachers, TSC employees, and their families but has expanded to include other professionals.

Why Save with Mwalimu National?

- High Dividends: Offers an average dividend payout of 12% annually on share capital.

- Diverse Products: Includes BOSA (Back Office Service Activities) loans, FOSA products, business loans, welfare loans, and investment options like property ownership.

- Low-Interest Loans: Competitive loan rates for development, emergency, and school fees loans.

- Nationwide Presence: Operates branches across Kenya, with mobile banking via the Mwalimu Go Mobile App.

- Member Feedback: Teachers like Jane Mwangi from Nairobi praise its tailored services for education professionals.

Membership Requirements:

- Open to teachers, TSC secretariat members, and their families.

- Minimum share capital: Ksh 20,000.

- Monthly contribution: Varies based on income.

Best For: Teachers and education sector employees seeking high dividends and comprehensive financial services.

2. Stima SACCO

Overview: Founded in 1974 to serve employees of the East African Power & Lighting Company, Stima SACCO has grown into one of Kenya’s top SACCOs, with an asset base of Ksh 53.78 billion. It now welcomes members from various sectors, including corporations and entrepreneurs.

Why Save with Stima SACCO?

- Innovative Services: First SACCO to introduce mobile banking, ATM services, and Sharia-compliant products.

- High Stability: Second-largest SACCO by asset base, ensuring financial security.

- Loan Flexibility: Offers development loans, mortgages, and asset financing at 1% per month on reducing balance.

- Diaspora Services: Caters to Kenyans abroad with tailored savings and investment options.

- Member Feedback: Peter Otieno from Kisumu credits Stima’s loans for enabling his business startup.

Membership Requirements:

- Open to all Kenyans, with no sector-specific restrictions.

- Registration fee: Ksh 2,500 (non-refundable).

- Minimum monthly contribution: Ksh 1,000.

Best For: Entrepreneurs and diaspora Kenyans seeking innovative banking solutions and competitive loan rates.

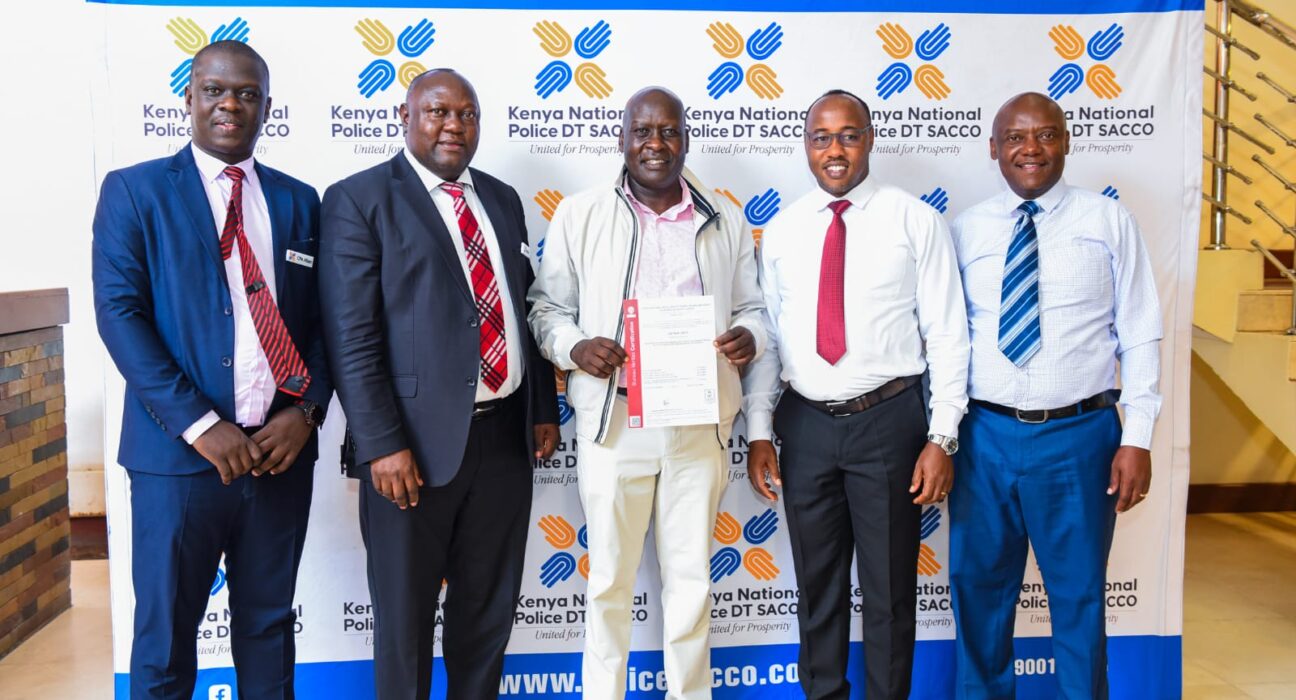

3. Kenya Police SACCO

Overview: Established in 1972, Kenya Police SACCO serves police officers and civilians, with an asset base of Ksh 54.24 billion and over 73,000 members. It was named the “Best Managed SACCO in Kenya” at the 2024 Ushirika Gala Awards.

Why Save with Kenya Police SACCO?

- Competitive Loans: Members can borrow up to three times their savings, with a 48-month repayment period.

- Strong Reputation: Known for excellent customer service and financial stability.

- Digital Access: Offers robust online and mobile banking platforms.

- Community Focus: Supports financial wellness for law enforcement and their families.

Membership Requirements:

- Open to all Kenyans, with a focus on police officers and their families.

- Minimum share capital: Ksh 20,000.

- Monthly contribution: Ksh 2,000 minimum.

Best For: Police officers and civilians seeking reliable savings and loan options with strong customer support.

4. Harambee SACCO

Overview: Founded in 1970 by low-income earners at the Office of the President, Harambee SACCO has grown to an asset base of Ksh 19.85 billion and over 80,000 members. It emphasizes unity and community development.

Why Save with Harambee SACCO?

- Inclusive Membership: Welcomes members from diverse backgrounds.

- Tailored Products: Offers savings schemes, loans for various purposes, and investment opportunities.

- Social Impact: Invests in community development projects, enhancing member welfare.

- Accessibility: Branches in major towns ensure easy access to services.

Membership Requirements:

- Open to all Kenyans above 18 years.

- Registration fee: Ksh 3,000.

- Minimum monthly contribution: Ksh 1,500.

Best For: Individuals seeking a community-driven SACCO with a focus on inclusivity and social impact.

5. Unaitas SACCO

Overview: Starting as a farmers’ cooperative in 1993, Unaitas SACCO now serves over 320,000 members with an asset base of Ksh 20.40 billion. It is a leader in supporting SMEs and individual investors.

Why Save with Unaitas SACCO?

- High Dividends: Offers dividends averaging 15% annually.

- Diverse Loan Portfolio: Includes business, agriculture, and mortgage loans at 1–1.1% per month.

- Digital Innovation: Extensive investment in IT systems for efficient online banking.

- Wide Reach: Branches in major towns like Nairobi, Nakuru, and Kisumu.

Membership Requirements:

- Open to individuals, investment groups, and small businesses.

- Registration fee: Ksh 2,000.

- Minimum share capital: Ksh 10,000.

Best For: Entrepreneurs and small business owners looking for flexible financial solutions.

6. Safaricom SACCO

Overview: Launched in 2010, Safaricom SACCO serves employees and stakeholders of Safaricom, with a focus on digital inclusion. It has a strong presence in major Kenyan towns.

Why Save with Safaricom SACCO?

- Tech-Driven Services: Offers mobile and online banking for seamless transactions.

- Competitive Rates: Attractive savings interest rates and affordable loan products.

- Investment Options: Includes fixed deposits and group investments.

- Member Feedback: Praised for its user-friendly digital platforms.

Membership Requirements:

- Open to Safaricom employees, retirees, and their relatives.

- Registration fee: Ksh 5,000.

- Minimum monthly contribution: Ksh 2,000.

Best For: Tech-savvy individuals and Safaricom employees seeking digital banking solutions.

7. Nyati SACCO

Overview: Established in 1977 for Kenya Wildlife Service employees, Nyati SACCO is renowned for paying the highest dividends in Kenya at 21% on share capital.

Why Save with Nyati SACCO?

- Top Dividends: Offers unmatched 21% dividend payouts.

- Financial Stability: Strong asset base and excellent customer support.

- Loan Packages: Competitive loans for personal and business needs.

- Investment Services: Includes real estate and government securities.

Membership Requirements:

- Open to all Kenyans, with a focus on KWS employees.

- Registration fee: Ksh 3,000.

- Minimum share capital: Ksh 15,000.

Best For: Investors seeking maximum returns through high dividends.

8. Hazina SACCO

Overview: Founded in 1971, Hazina SACCO serves public servants and all Kenyans, with an asset base of Ksh 20.94 billion and 15,000 members.

Why Save with Hazina SACCO?

- Flexible Loans: Offers loans up to 3.5 times savings with a 72-month repayment period.

- Mobile Banking: User-friendly platform for transactions via M-Pesa.

- Stability: Known for timely loan disbursements and dependable service.

- Member Focus: Prioritizes savings to empower members financially.

Membership Requirements:

- Open to all Kenyans, particularly public servants.

- Registration fee: Ksh 2,500.

- Minimum monthly contribution: Ksh 1,000.

Best For: Public servants and individuals seeking stable savings and loan options.

9. Afya SACCO

Overview: Afya SACCO, with an asset base of Ksh 20.94 billion, serves healthcare professionals and has expanded to include other members. It is known for competitive rates and technological investment.

Why Save with Afya SACCO?

- Competitive Rates: Offers better loan and savings rates than commercial banks.

- Large Fund Pool: Enables affordable loans for members.

- Tech Investment: Efficient services through advanced IT systems.

- Headquarters: Owns the prominent Afya Centre in Nairobi.

Membership Requirements:

- Open to healthcare professionals and other Kenyans.

- Registration fee: Ksh 3,000.

- Minimum share capital: Ksh 10,000.

Best For: Healthcare professionals seeking competitive financial products.

10. Jamii SACCO

Overview: Jamii SACCO, with an asset base of Ksh 66.43 billion, is a top performer according to the 2023 SASRA report. It operates in all 47 counties with a delegate system.

Why Save with Jamii SACCO?

- Fast Loan Disbursement: Approved loans disbursed within 24 hours.

- Low-Interest Loans: Rates as low as 1% per month.

- Strong Customer Support: Excellent service for members of all income levels.

- Investment Growth: Offers interest and dividends on savings.

Membership Requirements:

- Open to individuals and institutions.

- Registration fee: Ksh 2,500.

- Minimum monthly contribution: Ksh 1,000.

Best For: Individuals and institutions seeking fast, affordable loans and strong support.

Key Considerations When Choosing a SACCO

Selecting the right SACCO requires careful evaluation of several factors to ensure your savings are secure and your financial goals are met. Here are key considerations:

- Regulation and Licensing: Choose a SACCO regulated by SASRA to ensure compliance with financial standards. SASRA’s 2022 report indicates that 176 DT SACCOs and 183 NWDT SACCOs are registered, offering a level of security.

- Financial Stability: Check the SACCO’s asset base, profitability, and capital adequacy. Tier 1 SACCOs (assets above Ksh 5 billion) like Mwalimu National and Stima SACCO are generally more stable.

- Dividend and Interest Rates: Compare dividend payouts (10–21%) and interest rates on savings. Nyati SACCO’s 21% dividend is a standout, but others like Unaitas (15%) are also competitive.

- Membership Eligibility: Ensure you meet the SACCO’s criteria, such as profession (e.g., teachers for Mwalimu National) or location.

- Loan Terms: Evaluate loan interest rates (typically 1–1.5% per month), repayment periods (36–72 months), and borrowing limits (3–4 times savings).

- Accessibility: Look for SACCOs with branches in your area or robust digital platforms for mobile banking.

- Customer Reviews: Seek feedback from current members. Online forums like Reddit highlight mixed experiences, with some praising SACCOs like Unaitas for reliability and others warning against mismanaged ones like Biashara SACCO.

- Fees and Contributions: Check registration fees (Ksh 2,000–10,000) and minimum monthly contributions (Ksh 500–2,000).

Benefits of Saving with SACCOs

Saving with a SACCO offers unique advantages that align with Kenya’s economic and social goals:

- Higher Returns: SACCOs often provide dividends (10–21%) and interest on savings, surpassing bank savings accounts (7–10% annually for money market funds).

- Affordable Credit: Loans at 1% per month are significantly cheaper than bank rates, ideal for emergencies or business growth.

- Financial Discipline: Structured savings plans encourage regular contributions, fostering long-term financial habits.

- Community Empowerment: SACCOs reinvest in local projects, such as housing or education, benefiting members and their communities.

- Diaspora-Friendly: SACCOs like Stima and Kenya Qatar Diaspora SACCO offer tailored services for Kenyans abroad, including real estate investments and mobile banking.

Risks and Challenges of SACCOs

While SACCOs offer numerous benefits, there are risks to consider:

- Mismanagement: Some SACCOs suffer from poor governance, leading to financial losses. Reddit users have cited concerns about mismanaged SACCOs like KUSCCO.

- Liquidity Issues: Non-withdrawable savings in NWDT SACCOs can limit access to funds, making them unsuitable for emergency funds.

- Membership Restrictions: Some SACCOs limit membership to specific professions or regions, reducing accessibility.

- Withdrawal Delays: Exiting a SACCO can take 1–3 months, as noted in online discussions, which may hinder urgent financial needs.

To mitigate these risks, prioritize SASRA-regulated SACCOs with transparent financial reporting and a strong track record.

SACCOs for Specific Groups

SACCOs for Entrepreneurs

- Unaitas SACCO: Offers business loans and SME support with competitive rates.

- Jamii SACCO: Provides fast loan disbursements for business ventures.

- Mombo SACCO: Recognized for digital innovation, ideal for tech-savvy entrepreneurs.

SACCOs for Teachers

- Mwalimu National SACCO: Tailored for educators with specialized loan products.

- Gusii Mwalimu SACCO: Offers mobile banking and savings accounts for teachers.

SACCOs for Diaspora Kenyans

- Kenya USA Diaspora SACCO: Provides savings and investment options for Kenyans in the US.

- Kenya Qatar Diaspora SACCO: Caters to Kenyans in the Middle East with M-Pesa contributions.

- Stoke UK Diaspora SACCO: Serves Kenyans in Europe, Australia, and beyond.

SACCOs for Low-Income Earners

- Harambee SACCO: Inclusive membership with low contribution requirements.

- Hazina SACCO: Affordable loans and savings for public servants and others.

- Sheria SACCO: Offers high dividends and low-interest loans for diverse members.

How to Join a SACCO

Joining a SACCO typically involves the following steps:

- Research: Identify a SACCO that aligns with your financial goals and eligibility criteria.

- Check Requirements: Review membership fees, share capital, and monthly contributions.

- Submit Application: Provide identification documents (e.g., national ID, passport) and a passport-sized photo.

- Pay Fees: Pay the non-refundable registration fee and initial share capital.

- Start Saving: Make regular contributions to build your savings and qualify for loans.

Tips for Maximizing SACCO Benefits

- Save Consistently: Regular contributions increase your loan eligibility and dividend earnings.

- Leverage Loans: Use low-interest loans for productive investments like business or real estate.

- Attend Meetings: Participate in SACCO events to stay informed and network with members.

- Monitor Performance: Review annual reports and dividend payouts to ensure the SACCO’s financial health.

- Diversify Investments: Combine SACCO savings with other vehicles like money market funds for balanced growth.

SACCOs in Kenya offer a powerful avenue for saving, borrowing, and investing, with benefits like high dividends, affordable loans, and community support. Top SACCOs like Mwalimu National, Stima, Kenya Police, Harambee, and Unaitas stand out for their financial stability, innovative services, and member-centric approach. However, careful research is essential to avoid mismanaged SACCOs and ensure your savings are secure. By choosing a SASRA-regulated SACCO that aligns with your financial goals, you can unlock a world of opportunities for wealth creation and financial empowerment. Whether you’re a teacher, entrepreneur, or diaspora Kenyan, there’s a SACCO tailored to your needs in 2025.