The wealth of African leaders often comes from a combination of inheritance, business holdings, investments, and political office. While some rulers, especially monarchs, inherit dynastic wealth, others accumulate assets through diversified business interests.

| Rank | Leader | Title | Country | Estimated Net Worth (USD) | Source of Wealth / Notes |

|---|---|---|---|---|---|

| 1 | King Mohammed VI | Monarch | Morocco | $5.7 billion | Extensive real estate holdings, investments in banking, energy, and agriculture; royal family wealth largely transparent. |

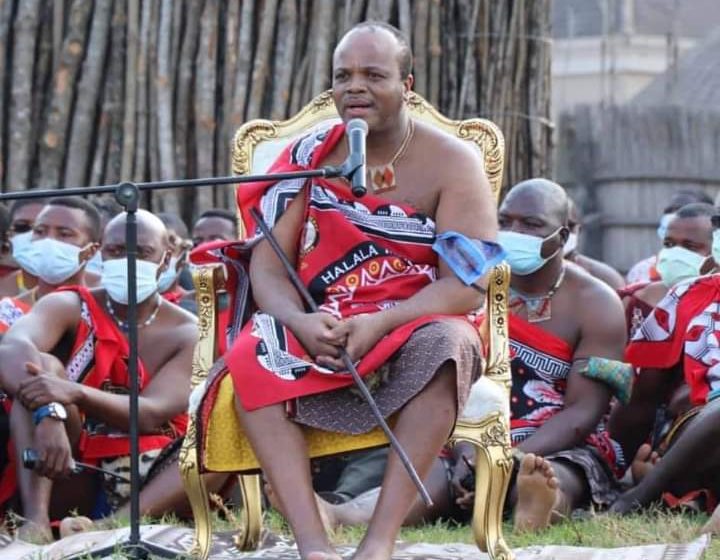

| 2 | King Mswati III | Monarch | Eswatini | $200 million – $1 billion | Personal estates, livestock, luxury assets; wealth estimates vary due to lack of transparency. |

| 3 | President Teodoro Obiang Nguema Mbasogo | President | Equatorial Guinea | $600 million – $700 million | Oil revenues, real estate in Europe and the US; long-term tenure enables accumulation of state-linked assets. |

| 4 | King Mohammed VI’s Family Trust | Monarch | Morocco | $400 million | Investment vehicles for royal assets and private companies. |

| 5 | King Letsie III | Monarch | Lesotho | $100 million – $300 million | Royal estates, land holdings, ceremonial privileges. |

| 6 | President Paul Biya | President | Cameroon | $200 million – $300 million | Long-serving leader with extensive business holdings and real estate in Cameroon and abroad. |

| 7 | King Goodwill Zwelithini | Monarch | South Africa (Zulu Nation) | $50 million – $100 million | Royal assets, cattle, and land; influence over regional economy. |

| 8 | President Muhammadu Buhari | Former President | Nigeria | $20 million – $50 million | Personal investments, pensions, and business ventures. |

| 9 | King Philippe & Royal Family | Monarch | Belgium (with African colonial historical wealth in Congo holdings) | Indirect African-linked wealth | Mainly historical and ceremonial; minor impact today. |

| 10 | President Uhuru Kenyatta | Former President | Kenya | $30 million – $60 million | Investments in agriculture, banking, and media; family holdings contribute substantially. |

Note: Exact net worth figures are difficult to verify, particularly for monarchs in Eswatini, Lesotho, and Equatorial Guinea, due to opacity in wealth reporting. Estimates are drawn from financial disclosures, investigative reporting, and international media sources.

Analysis and Insights

- Monarchs Dominate the List

Royalty makes up more than half of the wealthiest leaders, highlighting the accumulation of dynastic assets over generations. King Mohammed VI’s wealth is the most transparent, with investments spanning multiple industries in Morocco and abroad. - Political Tenure as a Wealth Driver

Long-serving presidents such as Teodoro Obiang and Paul Biya have amassed substantial wealth during decades in office. Control over natural resource revenues, particularly oil, enables these leaders to maintain economic influence beyond formal governance. - Regional Patterns

- North Africa hosts the wealthiest monarchs, particularly Morocco.

- Southern Africa has monarchs with lower but significant personal wealth.

- Central and West African leaders leverage natural resources to grow personal holdings.

- Economic Influence vs Personal Wealth

Wealth of leaders is often intertwined with state resources, creating political and economic leverage. In resource-rich nations, such as Equatorial Guinea, leaders’ wealth may exceed the GDP of small sectors or regions, impacting policy and investment decisions. - Transparency Challenges

Most African nations lack comprehensive public asset declarations for leaders. This opacity makes it difficult to distinguish personal wealth from state-linked assets. International reporting and investigative journalism are primary sources for estimates.

Trends and Implications

1. Global Attention on Wealth Accumulation

- International organizations and watchdogs increasingly monitor wealth accumulation by heads of state to combat corruption and illicit financial flows.

- Transparency and asset declaration initiatives are still limited in many countries.

2. Investment Opportunities

- Royal families and politically connected leaders often invest in agriculture, banking, real estate, and energy. These sectors present indirect opportunities for foreign investors in collaboration with local stakeholders.

3. Political Stability and Economic Impact

- Wealthy leaders with strong resource control can either stabilize or destabilize economies depending on governance approach. Countries like Morocco leverage monarchy wealth for social programs, whereas resource-heavy states like Equatorial Guinea face criticism for inequality and lack of public investment.

- Royal vs Elected Wealth Dynamics

- Monarchs rely on inherited wealth and ceremonial assets, while presidents accumulate wealth through tenure, resource control, and private investments. Both models have significant influence on domestic and regional economies.