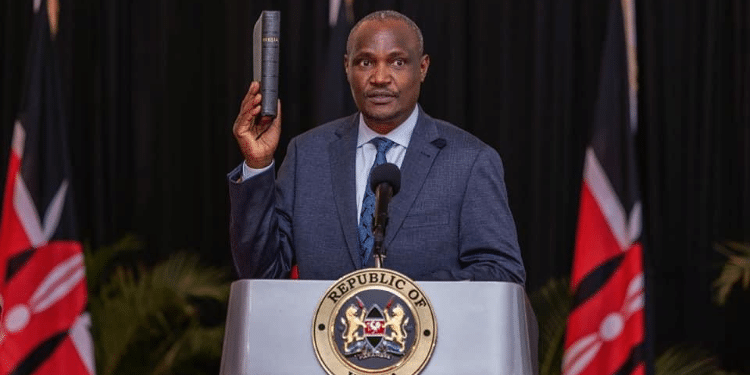

In a bid to boost Kenya’s revenue collection, Cabinet Secretary for the National Treasury and Economic Planning, Hon. John Mbadi, has called on the Kenya Revenue Authority (KRA) to adopt innovative and technologically advanced strategies. Speaking during a high-level meeting with KRA’s leadership and staff, CS Mbadi emphasized the critical need for continuous modernisation in tax administration.

The CS highlighted that modernisation is key to streamlining business processes, leveraging advanced systems, and simplifying tax transactions. “Our modernisation journey must align with both our objectives and those of taxpayers,” CS Mbadi stated. “This approach will not only benefit taxpayers but will also significantly boost our revenue mobilisation efforts.”

CS Mbadi underscored the transformative power of technology, noting its essential role in reforming taxpayer services, improving operational efficiency, and enhancing revenue collection. He further urged KRA to expand the tax base, particularly in sectors that have historically been difficult to tax. This strategy, he argued, will help protect existing businesses from bearing an excessive tax burden.

To support these efforts, CS Mbadi confirmed that the National Treasury will develop policies designed to guide KRA in revenue mobilisation. Instruments such as the National Tax Policy, he noted, will be key in expanding the tax base, enhancing fairness and equity in the tax system, and creating certainty and predictability in tax rates.

“Through the Policy, KRA must ensure higher tax compliance, improve the taxpayer experience, and reduce tax expenditures to minimize market distortions and tax refund pressures,” said the CS. He also mentioned that the Policy would introduce a framework for granting tax incentives that are time-bound and focused on growth.

Additionally, CS Mbadi highlighted the importance of short-term policies like the Medium-Term Revenue Strategy (MTRS) in enabling KRA to meet its revenue targets. “I will chair the Steering Committee on the Implementation of the Medium-Term Revenue Strategy to ensure we are all on track to achieve a tax-to-GDP ratio of 20 percent over the medium term,” he added.

During the same meeting, KRA Commissioner General Humphrey Wattanga announced plans to overhaul KRA’s IT infrastructure to establish more reliable systems capable of meeting modern business demands. He emphasized that modernisation is crucial for improving operational efficiency and enhancing KRA’s ability to detect and address potential tax evasion through data-driven decision-making.

“The adoption of cutting-edge technologies such as data science, machine learning, and Artificial Intelligence (AI) will strengthen our operational efficiency, ensure compliance, and elevate service delivery standards,” said the Commissioner General. He affirmed that these technological advancements would not only simplify tax administration but also enhance overall revenue performance and create a seamless experience for taxpayers.

The Commissioner General assured that KRA would continue implementing effective initiatives and robust policy reforms to fulfill its mandate of collecting revenue on behalf of the government.