Introduction

Foreign Direct Investment (FDI) is a critical component of the economic relationship between the UK and Kenya. This article examines the trends in FDI between the two countries, highlighting key data and implications for future investment flows.

Decline in UK FDI: Understanding the Numbers

In 2021, the stock of FDI from the UK in Kenya stood at £489 million, a significant 42.6% decrease from 2020. This decline may be attributed to various factors, including political instability, regulatory challenges, and economic uncertainties in Kenya. The decrease in FDI underscores the need for both countries to address these issues to attract more investment and foster economic growth.

Sectoral Distribution: Key Areas of Investment

UK FDI in Kenya is concentrated in sectors such as financial services, manufacturing, and telecommunications. These investments have been pivotal in fostering economic growth, creating jobs, and enhancing technological advancements in Kenya. The financial services sector, in particular, benefits from the influx of UK capital, which supports the development of banking and insurance services. Similarly, investments in manufacturing and telecommunications drive industrial growth and improve connectivity, contributing to overall economic development.

Future Prospects: Attracting More FDI

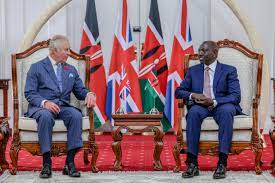

The decline in UK FDI in Kenya highlights the challenges that need to be addressed to create a more favorable investment climate. Strengthening regulatory frameworks, ensuring political stability, and providing incentives for investors can attract more FDI and drive economic growth. By creating a conducive environment for investment, Kenya can leverage UK expertise and capital to enhance its economic development. Additionally, fostering strong bilateral relations and promoting investment opportunities can further strengthen the economic ties between the two countries.

The decline in UK FDI in Kenya underscores the importance of addressing the underlying challenges hindering investment flows. Strengthening regulatory frameworks and ensuring political stability can attract more FDI, boosting economic growth and development in Kenya. By leveraging the potential of UK investments, Kenya can achieve sustained economic growth and improved living standards for its citizens.

Balancing Trade: Analyzing the UK-Kenya Trade Deficit in 2024

The trade balance between the UK and Kenya provides critical insights into the economic interactions and dependencies of the two countries. This article offers a detailed analysis of the trade balance, including key statistics and trends, to understand the dynamics of their economic relationship.

Trade Balance Overview: Key Figures

In the four quarters to the end of Q1 2024, the UK had a trade deficit with Kenya, importing more than it exported. UK exports to Kenya were valued at £654 million, while imports from Kenya amounted to £760 million, resulting in a trade deficit of £106 million. This trade deficit highlights the complementary nature of their trade relationship, where each country relies on the other’s strengths to meet its economic needs.

Key Commodities: Driving the Trade Deficit

The trade deficit is driven by the UK’s high demand for Kenyan agricultural products such as tea, coffee, and flowers. These products are integral to the UK market due to their high quality and competitive pricing, making them staples for UK consumers. On the other hand, UK exports to Kenya are dominated by machinery, pharmaceuticals, and electronic equipment, which are essential for Kenya’s development. The diversity of traded goods underscores the interdependence of the two economies and the mutual benefits derived from their trade relationship.

Addressing the Trade Deficit: Opportunities for Growth

While a trade deficit may appear negative, it also presents opportunities for growth and development. The UK’s demand for Kenyan products supports Kenya’s agricultural sector and provides employment opportunities. Conversely, Kenya’s need for UK machinery and pharmaceuticals drives industrial and healthcare advancements. Addressing the trade deficit requires both countries to explore new trade opportunities, enhance product quality, and strengthen economic ties. By focusing on value addition and diversification, Kenya can increase its exports and reduce the trade deficit, achieving a more balanced trade relationship.

Conclusion

The trade deficit between the UK and Kenya underscores the complementary nature of their trade relationship. By leveraging their comparative advantages and addressing the underlying challenges, both countries can continue to benefit from mutual trade, fostering economic growth and development. Strengthening trade relations and exploring new opportunities can enhance the economic prosperity of both nations, ensuring sustained growth and improved living standards.