The yield curve is a crucial economic indicator that offers insights into the future performance of an economy. It’s a graphical representation showing the relationship between interest rates and the maturity dates of debt securities, such as bonds. In Kenya, the yield curve plays a significant role in determining the returns on money market funds (MMFs), which are popular investment vehicles for both individual and institutional investors. This article delves into the concept of the yield curve, how it works, and its impact on money market funds in the Kenyan context.

What is the Yield Curve?

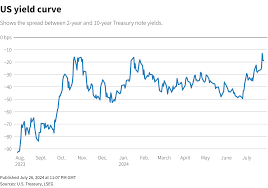

The yield curve is a graph that plots the yields (interest rates) of bonds of the same credit quality but different maturities. Typically, the curve shows short-term bonds on the left and long-term bonds on the right. The shape of the yield curve can provide valuable insights into economic conditions. There are three primary shapes of the yield curve: normal, inverted, and flat.

- Normal Yield Curve: This is the most common shape, where long-term bonds have higher yields than short-term bonds. It indicates that the economy is expected to grow steadily.

- Inverted Yield Curve: This occurs when short-term bonds have higher yields than long-term bonds, often signaling an upcoming recession.

- Flat Yield Curve: When the yields on short-term and long-term bonds are relatively equal, it may indicate economic uncertainty or a transition period in the economy.

How the Yield Curve Affects Money Market Funds

Money market funds (MMFs) are investment funds that invest in short-term, high-quality debt securities, including Treasury bills, commercial paper, and certificates of deposit. The performance of MMFs is closely tied to the interest rates, which are influenced by the shape of the yield curve.

When the yield curve is normal, MMFs generally offer lower returns compared to longer-term investments because short-term interest rates are lower. However, in an inverted yield curve scenario, MMFs may become more attractive as short-term rates rise, potentially offering higher returns than long-term investments. A flat yield curve can result in relatively stable but lower returns across different investment durations.

The Current State of the Yield Curve in Kenya

In Kenya, the Central Bank of Kenya (CBK) plays a significant role in influencing the yield curve through its monetary policy decisions. The CBK adjusts the benchmark interest rate, known as the Central Bank Rate (CBR), to manage inflation and stimulate economic growth. Changes in the CBR directly impact the short end of the yield curve, affecting the returns on MMFs.

As of recent years, Kenya has experienced a relatively stable yield curve, with the CBK maintaining a cautious stance on interest rates to balance inflation and growth. However, external factors, such as global economic conditions and domestic fiscal policies, can cause fluctuations in the yield curve, impacting MMF returns.

Impact of an Inverted Yield Curve on MMFs in Kenya

An inverted yield curve, though rare, can have significant implications for money market funds in Kenya. If short-term interest rates rise above long-term rates, MMFs could offer higher returns than traditional long-term investments, such as bonds. However, an inverted yield curve is often a precursor to economic downturns, which could lead to increased market volatility and potential losses in other asset classes.

For investors in Kenya, an inverted yield curve may present an opportunity to capitalize on higher short-term rates by allocating more funds to MMFs. However, it’s crucial to be cautious and monitor economic indicators closely, as the underlying economic conditions could deteriorate, affecting the overall investment landscape.

Strategies for Investors During Different Yield Curve Scenarios

Investors in money market funds must consider the yield curve when making investment decisions. During a normal yield curve, it may be prudent to diversify investments across different maturities to balance risk and return. In contrast, during an inverted yield curve, investors might focus more on short-term instruments, which could offer better returns.

In a flat yield curve environment, investors may need to manage expectations and prepare for modest returns. It’s essential to have a clear investment strategy aligned with one’s risk tolerance and financial goals. Consulting with financial advisors or investment professionals can also provide valuable insights into navigating the complexities of the yield curve.

Risks and Considerations for Kenyan Investors

While money market funds are generally considered low-risk investments, they are not without risks, especially in a fluctuating yield curve environment. Interest rate risk is a primary concern, as changes in interest rates directly affect the returns on MMFs. Additionally, credit risk, though minimal in MMFs due to their investment in high-quality securities, should still be considered.

Kenyan investors should also be aware of liquidity risk, particularly if they need to access their funds quickly. While MMFs are designed to provide liquidity, sudden market shifts could impact the ease of withdrawing funds without incurring losses. Understanding these risks is crucial for making informed investment decisions.

The Role of Regulatory Oversight in Kenya

The Capital Markets Authority (CMA) in Kenya regulates money market funds, ensuring they adhere to stringent guidelines to protect investors. The CMA’s oversight includes monitoring the quality of assets held by MMFs, the fund managers’ adherence to investment limits, and the transparency of reporting.

Regulatory oversight provides a safety net for investors, ensuring that MMFs remain a viable and relatively safe investment option. However, investors should still perform due diligence by reviewing fund prospectuses, understanding the underlying assets, and staying informed about market developments.

Future Outlook: The Yield Curve and MMFs in Kenya

The future of money market funds in Kenya will be influenced by both domestic and global economic conditions. As the global economy evolves, factors such as interest rate changes by major central banks, inflation trends, and geopolitical developments will play a role in shaping Kenya’s yield curve.

For Kenyan investors, staying informed about these developments and understanding how they impact the yield curve is essential. By doing so, they can make strategic decisions that align with their financial goals and navigate the complexities of the investment landscape.

Conclusion: Navigating the Yield Curve with Confidence

Understanding the yield curve is critical for anyone investing in money market funds in Kenya. The shape of the yield curve provides valuable insights into the economy’s future direction and influences the returns on MMFs. By staying informed and adopting appropriate investment strategies, investors can optimize their portfolios and achieve their financial objectives, even in uncertain economic times. Whether you are a seasoned investor or just starting, comprehending the yield curve’s impact on MMFs will equip you with the knowledge to make informed decisions in Kenya’s dynamic financial landscape.