Money Market Funds (MMFs) are a popular investment vehicle, particularly for investors looking for stability and liquidity. These funds are designed to provide investors with a safe place to park cash, earn returns that are typically higher than traditional savings accounts, and maintain easy access to their money. However, like all investments, the performance of Money Market Funds is influenced by a variety of factors. Understanding these factors is crucial for making informed investment decisions and managing expectations. Below, we explore the key elements that affect the performance of Money Market Funds.

Interest Rates and Central Bank Policies

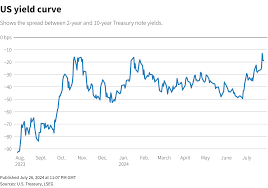

Interest rates are one of the most significant factors influencing the performance of Money Market Funds. MMFs invest primarily in short-term, high-quality debt securities, such as Treasury bills, commercial paper, and certificates of deposit. The returns on these instruments are directly affected by prevailing interest rates set by central banks. When interest rates rise, the yield on newly issued short-term debt increases, which can lead to higher returns for MMFs. Conversely, when interest rates fall, the yield on these instruments decreases, which can reduce the returns for MMF investors.

Inflation Rates

Inflation is another critical factor that affects Money Market Funds. Inflation erodes the purchasing power of money over time, meaning that even if your MMF generates a positive return, the real value of your investment might decrease if inflation is higher than the fund’s yield. Central banks often adjust interest rates in response to inflation, which in turn affects MMF returns. During periods of high inflation, central banks may raise interest rates to curb rising prices, potentially increasing MMF yields. However, persistent high inflation can still diminish the real return on your investment.

Credit Quality of Fund Holdings

The credit quality of the securities held by a Money Market Fund plays a significant role in its performance. MMFs typically invest in debt instruments issued by governments, financial institutions, and corporations with high credit ratings. The higher the credit quality of these holdings, the lower the risk of default, which generally leads to more stable returns. However, funds that take on higher credit risk by investing in lower-rated securities may offer higher yields but also expose investors to greater risk. The performance of the fund can be adversely affected if the credit quality of its holdings deteriorates or if there is a default.

Market Liquidity

Liquidity refers to how easily assets can be bought or sold in the market without affecting their price. For Money Market Funds, liquidity is crucial because these funds need to be able to meet redemption requests from investors on short notice. If the market for the securities held by the fund becomes less liquid, the fund may struggle to sell assets quickly without incurring losses. A decline in market liquidity can negatively impact the performance of the fund, particularly during periods of financial stress when investors may rush to withdraw their investments.

Regulatory Changes

Money Market Funds are subject to regulations that can impact their performance. Regulatory bodies, such as the Capital Markets Authority (CMA) in Kenya, may impose rules on MMFs regarding liquidity requirements, portfolio composition, and risk management. For example, regulations that require higher liquidity buffers can limit the fund’s ability to invest in higher-yielding but less liquid securities, potentially reducing returns. Additionally, changes in tax laws or other regulations can also affect the attractiveness of Money Market Funds as an investment option.

Economic Conditions

The overall economic environment significantly influences the performance of Money Market Funds. During periods of economic growth, businesses and governments may issue more short-term debt to finance expansion, providing MMFs with more investment opportunities. Conversely, during economic downturns, the supply of high-quality short-term debt may shrink, and the risk of defaults may increase, which can negatively impact the performance of MMFs. Moreover, economic conditions also affect interest rates and inflation, further influencing fund returns.

Fund Management Strategy

The management strategy of a Money Market Fund can have a significant impact on its performance. Fund managers make crucial decisions about which securities to buy, hold, or sell, and these decisions are influenced by their assessment of interest rates, credit risks, and market conditions. Some fund managers may adopt a conservative approach, focusing on high-quality, low-risk securities, while others may take on more risk in pursuit of higher returns. The effectiveness of the fund manager’s strategy and their ability to anticipate market changes are critical to the fund’s overall performance.

Investor Behavior

Investor behavior can also affect the performance of Money Market Funds. Large inflows or outflows of money can force the fund to buy or sell securities, potentially at unfavorable prices. For example, if a significant number of investors withdraw their money during a market downturn, the fund may have to sell assets at a loss to meet redemption requests, which can negatively impact the remaining investors. Conversely, large inflows of capital can provide the fund with more opportunities to invest, potentially boosting returns if managed well.

Global Events and Geopolitical Risks

Global events, such as political instability, economic sanctions, or natural disasters, can create uncertainty in financial markets and impact the performance of Money Market Funds. Geopolitical risks can lead to fluctuations in interest rates, changes in government policies, and shifts in investor sentiment, all of which can affect the yields on the securities held by MMFs. Additionally, global financial crises can reduce the availability of high-quality debt instruments, forcing funds to either take on more risk or accept lower returns.

Exchange Rate Movements

For Money Market Funds that invest in foreign-denominated securities, exchange rate movements can influence performance. Fluctuations in currency exchange rates can affect the value of foreign investments when converted back to the fund’s base currency. For example, if the Kenyan shilling depreciates against the currency in which the fund’s investments are denominated, the value of those investments may increase in shilling terms, boosting the fund’s performance. Conversely, if the shilling appreciates, the value of foreign-denominated investments may decline.

Conclusion

The performance of Money Market Funds is influenced by a complex interplay of factors, ranging from interest rates and economic conditions to fund management strategies and investor behavior. Understanding these factors can help investors make more informed decisions about when to invest in MMFs and how to manage their expectations regarding returns. While Money Market Funds are generally considered low-risk investments, they are not entirely immune to market fluctuations and other risks. By staying informed and considering the broader economic and financial landscape, investors can better navigate the challenges and opportunities presented by Money Market Funds.