Kenya, facing a severe budget shortfall and delays in a crucial $600 million International Monetary Fund (IMF) disbursement, is now seeking a substantial $1.5 billion loan from Abu Dhabi at an interest rate of 8.2%. This move is part of an urgent effort to bridge a growing budget deficit, which has been exacerbated by forced tax measure rollbacks following deadly protests.

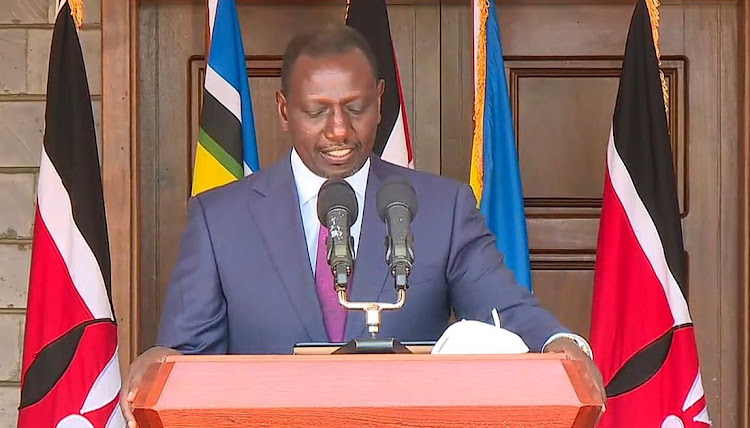

The Treasury is currently navigating a precarious fiscal situation. Recent social unrest compelled President William Ruto’s administration to abandon tax policies projected to generate $2.7 billion this fiscal year. This withdrawal has left a gaping hole in the country’s budget, expanding the deficit to 4.3% of the gross domestic product (GDP) from an initial target of 3.3%—potentially breaching agreed-upon targets with the IMF.

To manage this shortfall, Kenya plans to secure approximately $2.8 billion in foreign loans and borrow an additional $3.2 billion domestically. The negotiation with Abu Dhabi for a $1.5 billion loan is a critical component of this broader financial strategy. This financial assistance from Abu Dhabi continues a trend of support for African nations, following a substantial $35 billion bailout provided to Egypt earlier this year.

Kenya’s urgent pivot to secure international loans underscores the broader economic pressures facing many developing economies today. As the country awaits the IMF’s delayed disbursement, these new loans are deemed crucial for stabilizing Kenya’s financial standing and supporting ongoing economic reforms aimed at long-term fiscal sustainability.

This financial strategy, while vital in the short term, invites scrutiny and debate about the long-term implications of such substantial foreign debts and the conditions tied to these funds. As Kenya navigates these challenging economic waters, the outcomes of these financial maneuvers will be closely watched both locally and internationally.