If you’re planning to travel within the COMESA (Common Market for Eastern and Southern Africa) region, applying for the COMESA Yellow Card insurance is essential. This third-party motor vehicle insurance scheme facilitates the seamless movement of vehicles, goods, and people across borders, protecting you against third-party risks that might arise during your journey. In this article, we’ll explore the steps to apply for the COMESA Yellow Card, its benefits, and additional information to help you prepare for a smooth cross-border trip.

What is the COMESA Yellow Card?

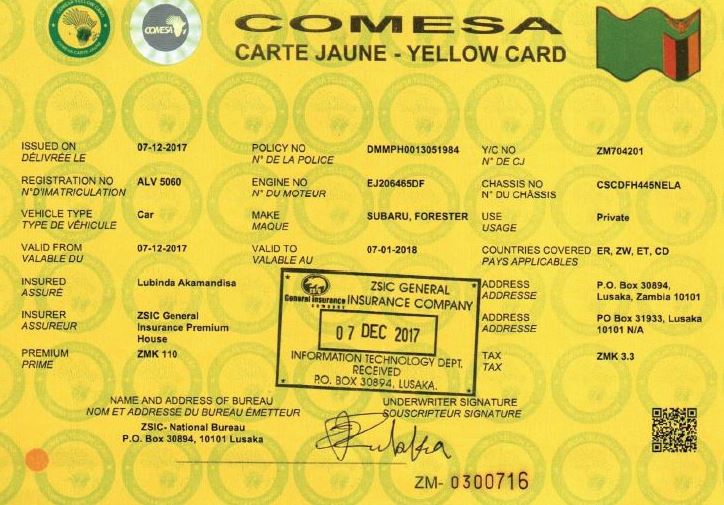

The COMESA Yellow Card is a third-party motor vehicle insurance policy that provides coverage for accidents involving your vehicle while traveling within the COMESA region. It is essentially an extension of your existing motor insurance, offering protection against third-party liabilities such as bodily injuries, property damage, and medical expenses for passengers and drivers in case of an accident. The card has a standard look for uniformity across the COMESA countries.

One key detail to note is that the Yellow Card is not applicable in the country of origin. For example, if you purchase the Yellow Card in Kenya, it won’t cover accidents that happen within Kenya itself but will apply to all other COMESA countries.

Countries Where the COMESA Yellow Card is Valid

The COMESA Yellow Card is valid in the following countries:

- Kenya

- Uganda

- Tanzania

- Rwanda

- Burundi

- Ethiopia

- Djibouti

- Sudan

- Eritrea

- Malawi

- Zambia

- Zimbabwe

- Democratic Republic of Congo (DRC)

It is important to note that most countries in this region have made third-party insurance mandatory for motor vehicles. Therefore, carrying a COMESA Yellow Card helps you comply with these requirements, avoiding potential legal issues at border crossings.

What the COMESA Yellow Card Covers

The Yellow Card offers comprehensive protection for third-party liabilities, which include:

- Medical Expenses: Covers costs for treating injuries sustained by third parties in an accident involving your vehicle.

- Third-Party Liability: Covers damages to other vehicles, properties, or injuries to passengers and pedestrians.

This insurance does not cover damages to your vehicle (comprehensive cover) or personal injury protection for the driver.

How to Apply for COMESA Yellow Card Insurance

Applying for a COMESA Yellow Card is straightforward, and it can be done through the same insurance company that provides your existing motor insurance. Here are the steps to apply:

- Contact Your Insurance Provider: Get in touch with your motor vehicle insurance provider and inquire about the COMESA Yellow Card. Over 100 insurance companies across the COMESA region are authorized to issue the Yellow Card. If your current provider is not part of the scheme, they may refer you to an eligible insurer.

- Provide Required Documentation: You will need to provide several documents when applying for the Yellow Card, including:

- A copy of your motor vehicle insurance policy (primary cover).

- Proof of vehicle ownership (logbook).

- A valid driver’s license.

- Passport or national ID for personal identification.

- Any relevant permits if applicable to specific countries.

- Specify Travel Details: You’ll need to specify the countries you plan to visit, the number of passengers in your vehicle, and the duration of your trip. The Yellow Card is issued based on these details, and the cost varies accordingly. For instance, the cost is typically higher for longer trips and vehicles carrying more passengers.

- Obtain and Pay for the Yellow Card: The insurance provider will process your application, and you’ll pay a fee based on your travel duration and vehicle type. After payment, you will receive the physical Yellow Card.

Digital Access to COMESA Yellow Card

In a move to modernize the process, COMESA recently launched the Digital Yellow Card Mobile App. The app allows users to access real-time information about their insurance, check the validity of Yellow Cards, and verify the authenticity of issued cards. This feature is helpful for both travelers and border officials, streamlining the process of insurance verification. The app can be downloaded from the Google Play Store or the Apple App Store.

Why You Need the COMESA Yellow Card

Carrying the COMESA Yellow Card when traveling through multiple countries within the COMESA region is crucial for several reasons:

- Compliance with Local Laws: It helps you comply with third-party insurance regulations in the participating countries.

- Seamless Border Crossing: With the Yellow Card, you don’t have to purchase separate insurance at each border, simplifying the process of moving between countries.

- Financial Protection: In case of an accident, the Yellow Card ensures that third-party liabilities such as medical expenses and damages are covered, protecting you from potentially costly legal or financial claims.

The COMESA Yellow Card is an essential tool for motorists planning to travel across multiple countries within the COMESA region. By covering third-party liabilities, it ensures a hassle-free journey, giving you peace of mind as you navigate different jurisdictions. Ensure you apply for the Yellow Card well before your trip by contacting your insurance provider, and consider utilizing the digital app for easier management of your insurance details.

With this guide, you’re now well-informed on how to apply for the COMESA Yellow Card and why it’s a critical asset for anyone traveling through the region by road. Safe travels!