Kenya has taken a significant step in positioning Nairobi as a regional hub for global finance, digital innovation, and regulated virtual assets following a series of high-level engagements by the Nairobi International Financial Centre Authority (NIFC) at the World Economic Forum in Davos.

The engagements brought together international investors, technology leaders, and fund managers, underscoring growing confidence in Kenya’s financial architecture and regulatory environment as global capital increasingly seeks stable, well-governed emerging market destinations.

A key highlight was a private leadership breakfast hosted by SCC Fund SP, ChainBLX SPC, and Digital.Davos, where NIFC engaged global stakeholders on the deployment of compliant blockchain infrastructure, institutional-grade digital platforms, and scalable innovation models aligned with international regulatory standards.

Investor commitments signal momentum

The Davos meetings translated into tangible outcomes, with ChainBLX SPC and SCC Fund SP confirming plans to establish operations in Kenya, supported by the Nairobi International Financial Centre Authority. The planned entry of the two firms is expected to strengthen Nairobi’s ecosystem for financial services, digital infrastructure, and alternative investment platforms.

NIFC said the engagements marked an important milestone in Kenya’s investment agenda, shifting the narrative from early-stage experimentation toward structured, regulated, and commercially viable financial markets.

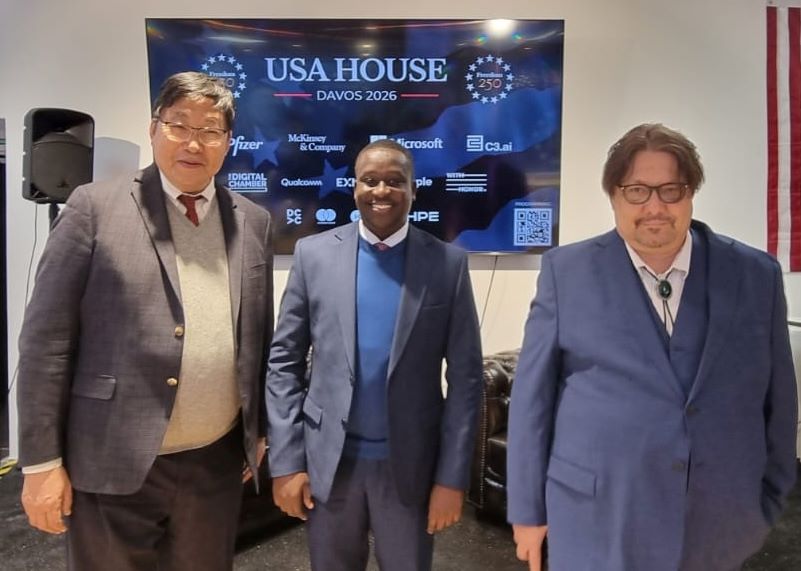

Speaking during the forum, NIFC Chief Executive Officer Daniel Mainda said Kenya was deliberately repositioning itself as a trusted platform for capital and innovation.

“Kenya has made a deliberate shift from momentum to architecture. Through the Nairobi International Financial Centre, we are building markets — not experiments — anchored in regulatory clarity, strong institutions and real economic outcomes,” Mainda said.

He added that Nairobi is increasingly positioning itself as Africa’s base for regulated digital assets, venture capital, private equity, and high-growth companies seeking access to regional markets.

“We will compete on regulatory quality, not regulatory arbitrage — and we are open for serious business,” he said.

Regulatory clarity drives digital asset interest

Central to Kenya’s pitch in Davos was progress on regulation for digital and virtual asset service providers. Following the enactment of the Virtual Asset Service Providers Act and supporting regulations, Nairobi is emerging as one of the few African jurisdictions offering a clear and structured framework for international digital asset firms.

The regulatory framework is designed to balance innovation with investor protection, governance, and financial system stability, a combination increasingly demanded by institutional capital.

Industry players at Davos noted that regulatory certainty, rather than permissive environments, is becoming the key determinant for where digital asset firms choose to locate regional headquarters.

Karl Seelig, Founder and Managing Partner of ChainBLX SPC, said Kenya’s approach stood out for combining innovation with governance.

“Kenya’s approach combines regulatory certainty with a strong innovation ecosystem. The collaboration with NIFC reflects a shared commitment to building compliant, scalable digital infrastructure with real commercial relevance,” Seelig said.

Positioning Nairobi as a regional platform

Beyond digital assets, discussions in Davos also focused on Nairobi’s broader positioning as a base for regional financial operations. NIFC highlighted incentives and facilitation support available to firms establishing regional headquarters, holding companies, venture capital funds, and private equity platforms in Kenya.

The authority said Nairobi offers a unique mix of regulatory clarity, skilled talent, improving digital infrastructure, and access to East and Central African markets, making it an increasingly attractive alternative to more established global financial centres for Africa-focused strategies.

SCC Fund SP Fund Chief Executive Officer Dr Yutaka Niihara said the discussions reflected growing international confidence in Nairobi.

“Kenya is demonstrating how forward-looking regulation and digital infrastructure can support trusted innovation at scale. The discussions in Davos reflect growing confidence in Nairobi as a regional platform,” Niihara said.

Linking capital markets to national development

In parallel, NIFC engagements at the World Economic Forum underscored Kenya’s advancing work on national capital mobilisation platforms, including the National Infrastructure Fund and broader sovereign investment frameworks.

These platforms are aimed at crowding in long-term private capital for commercially viable infrastructure projects while improving project preparation, governance, and delivery. Officials said aligning global capital with structured national investment vehicles is critical to closing infrastructure financing gaps without over-reliance on public debt.

Kenya’s participation in Davos also reflected a broader strategy to connect financial innovation, capital markets, and real economy outcomes, including green finance, carbon markets, and sustainable infrastructure.

NIFC said Nairobi is actively courting firms across financial services, fintech, digital assets, and climate finance, positioning the city as a gateway for capital deployment into Africa’s growth sectors.

Competing on trust and governance

As global investors reassess risk, governance, and regulatory standards across emerging markets, Kenyan officials argue that trust, institutional strength, and regulatory predictability are becoming decisive competitive advantages.

NIFC said Kenya’s value proposition is increasingly built around compliance, transparency, and long-term partnership rather than short-term incentives.

“As global capital increasingly prioritises jurisdictions that combine innovation with trust, Kenya continues to position itself as a credible and competitive partner for long-term investment,” the authority said in a statement.

The Davos engagements reinforce Kenya’s ambition to move beyond being a frontier market for experimentation and instead become a structured, regulated, and scalable platform for capital, innovation, and financial services across Africa.